After the loss, theft, appropriation or unauthorised use of a payment instrument is detected (Article 69 PSD2), the customer is obliged to report that to the payment services provider. Good news for the customers is that online banking security is examined in the context of reducing their liability for unauthorised transactions. The idea is that the violation of one of them does not compromise the reliability of the other. The components must be independent from one another.

The most important aspect in terms of security is the so-called “strong customer authentication”. The PSD2 Directive brought significant changes both for the banks offering online banking services and for the customers. Decisions concerning the online banking security are made also at the EU level which may be proved by the PSD2 Directive (Payment Services Directive) and the less known Commission Delegated Regulation (EU) 2018/389 (termed RTS, a supplement to PSD2). Quite the opposite, the recommendations are provided by state supervisory bodies. As the financial sector is particularly exposed to cybercrime, the security aspects are not governed by the banks themselves. Whether the money deposited by customers in their bank accounts and their personal data remain outside the reach of any unauthorised parties is conditional on the adopted solutions. Security is of key importance in the banking sector. What solutions are used by banks now? Are they sufficiently secure? Online banking security software - legal requirements

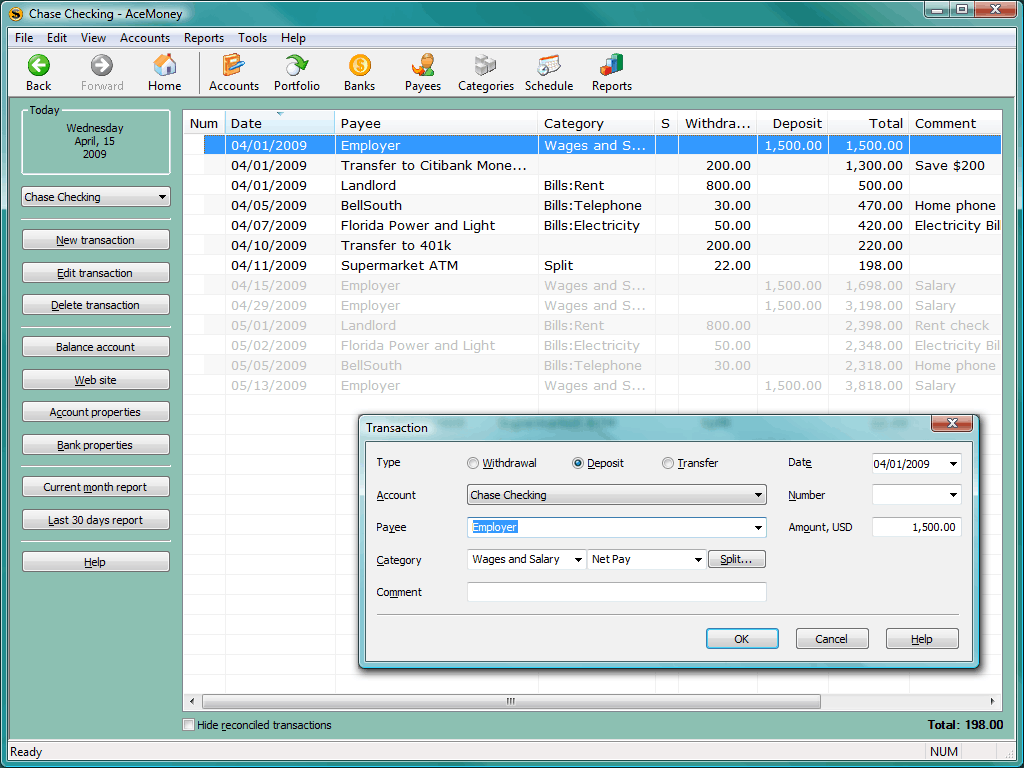

Using the platform provided by the bank, they may order transfers or apply for a loan. E-banking enjoys high interest of customers.

0 kommentar(er)

0 kommentar(er)